Digital Banking

Interior Federal’s digital banking* was designed with you in mind. You can manage your accounts quickly, securely, and easily 24/7 whether you’re on your couch, on the go, or anywhere in between. Enroll in Online Banking and download the Mobile App for your tablet, smart phone, or smart watch.

Manage Accounts

Security Features

Transfer & Pay

Tools & Resources

Additional Services

Member Service

- Call

- Secure Support

- Locations

Alerts

Set up alerts and notifications to stay secure, or just stay up to date. Login to Online or Mobile Banking to enable email or mobile alerts about accounts, activity, and due dates.

Online Banking: Login, click on Notifications and then Settings to set up email or text alerts.

Mobile Banking: Login, tap on More and then Settings to set up Push Notifications and Quick Balance alerts.

Browser Requirements

E-Statements

Opting for e-statements (paperless) statements benefits both you and the environment!

- Secure – They’re protected by your sign on and password, so they can’t get stolen in the mail.

- Convenient – You can review and print statements anytime, and even save them to your computer.

- Green – You can help the environment by reducing paper and keeping down office clutter.

To sign up, log into online banking, navigate to Additional Services, click on E-Statements/Notices/Taxes and select Enrollment.

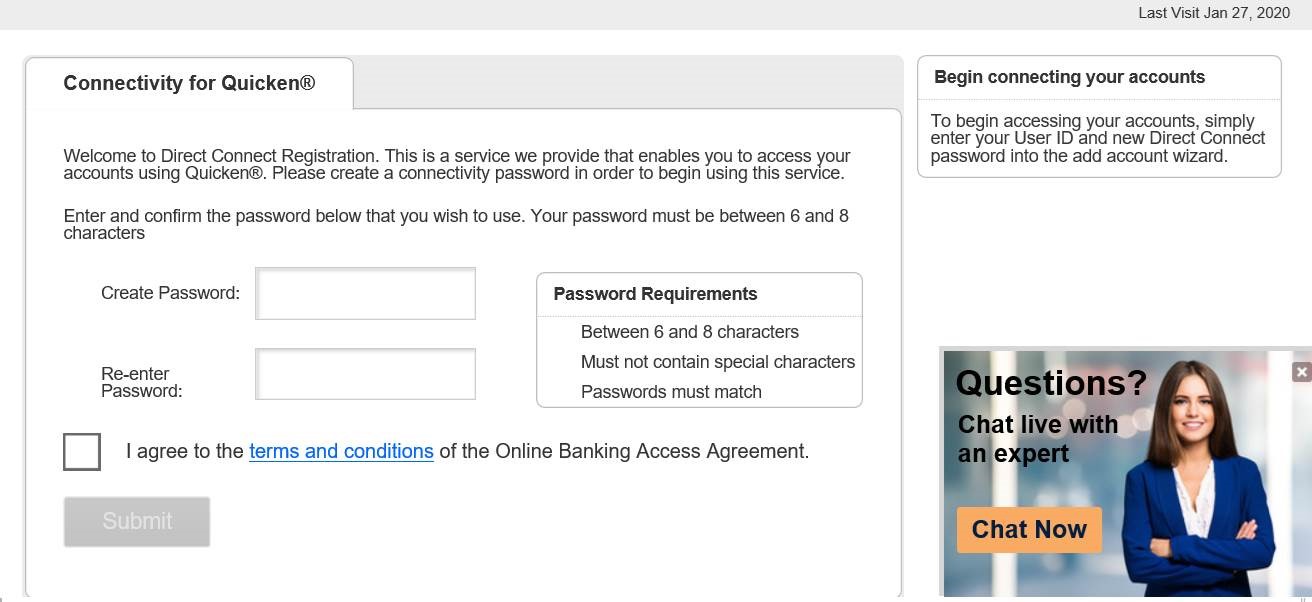

Quicken®

Quicken® provides a comprehensive view of your financial life all in one place, and now you can seamlessly sync it with your Interior Federal Online Banking.

Here’s how to set it up:

- Log in to Online Banking.

- Go to the Money Management tab.

- Select Connectivity for Quicken®.

- Follow the prompts to create a password. You can then use the password along with your online banking username to sync your banking with Quicken®.

If you need your Quicken credentials reset, please contact us. Alternatively, you can give us a call during business hours at (800) 914-8619.

Secure Support

For Online Banking: login, click on ‘Support’ and then select ‘Secure Chat’ or ‘Secure Email’.

For Mobile Banking: login, tap on ‘More’ and then select ‘Secure Chat’ or Secure Email’.

Shared Access

You can give permission to allow anyone to access your account information. You’re able to control which accounts a sub-user has access to. Once you grant access to an account, you are then able to choose whether you want the sub-user to have view only access or allow them to perform certain types of transactions. You will also have the ability to control whether the sub-user can add/edit existing payees for any transaction types they have access to.

- View Only access allows the sub-user to see the account(s) on the home page, the balance, and the transaction history on the history page.

- You can set a per transaction limit for Bill Pay and ACH payments.

- A sub-user cannot access e-statements or third party services.

You can set up shared access by logging into online banking, clicking on Additional Services, selecting Share Access With Others and following the prompts.

*Message or data rates may apply depending on your wireless plan. Web access is needed to use Mobile Banking. Check with your service provider for details on specific fees and charges.

Important: We will never send confidential information such as User’s ID’s, passwords or complete account numbers via the Internet.

Questions?