June 14, 2024

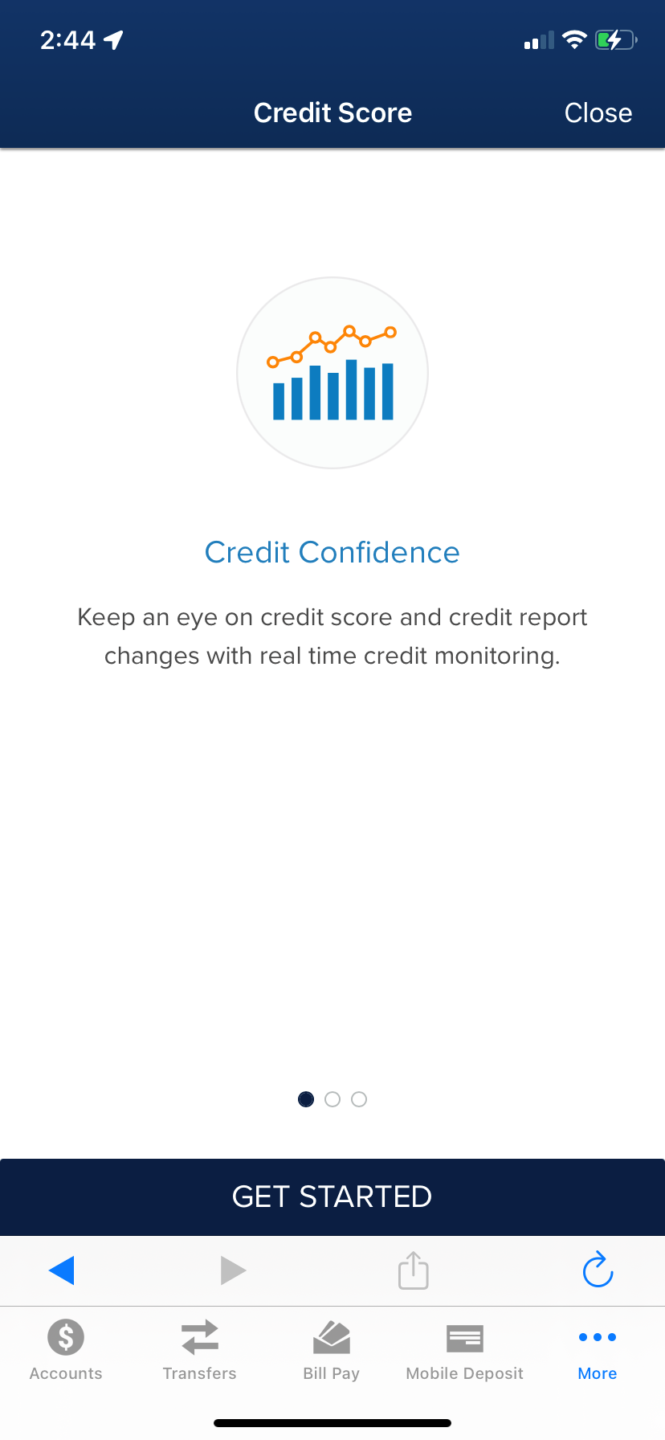

Boost Your Financial Health with Credit Score

Improving your credit score can feel like a daunting task, but with the right tools and knowledge, it becomes much more manageable. Credit Score is a free service we offer through Digital Banking. With one click, you can check your credit score, view your credit report, and get up to date credit monitoring notifications.

Features:

- Check your credit score daily

- Monitor credit for unusual activity

- Get alerts for changes to your credit

- View your full credit report

- Visualize what affects your credit score

- Simulate how future actions may impact your score

- Dispute items on your credit report

- Get tips on rebuilding credit & saving money

Benefits of Credit Score to Help You Improve Your Score:

- Stay up-to-date without affecting your credit

Many people worry that by checking their credit score too much they will see their score drop. Using Credit Score to check your score is what is known as a “soft inquiry,” which does not affect your credit score. Lenders use “hard inquiries” to make decisions about your credit worthiness when you apply for loans.

- Monitor your credit to prevent fraud and identity theft

Credit Score also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, change in address or employment, if a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft.

- Common sense tools for managing your credit

Credit score helps you visualize the relationship of your credit score with payment history, usage, or opening & closing of accounts. Use the credit score simulator to see the potential impact of opening new accounts or paying off balances. This interactive tool will simulate your credit scores before you actually take action.

Try out the simulator to see what might happen if you:

- Pay off a credit card

- Take out a new loan

- Miss a payment

- Helpful information to empower you

Based on your Credit Score information, you may receive helpful articles. The articles, written by Jean Chatzky and the SavvyMoney team, provide helpful tips on how you can manage credit and debt wisely. Our goal is to empower you with the information to make the most out of your money.

How to:

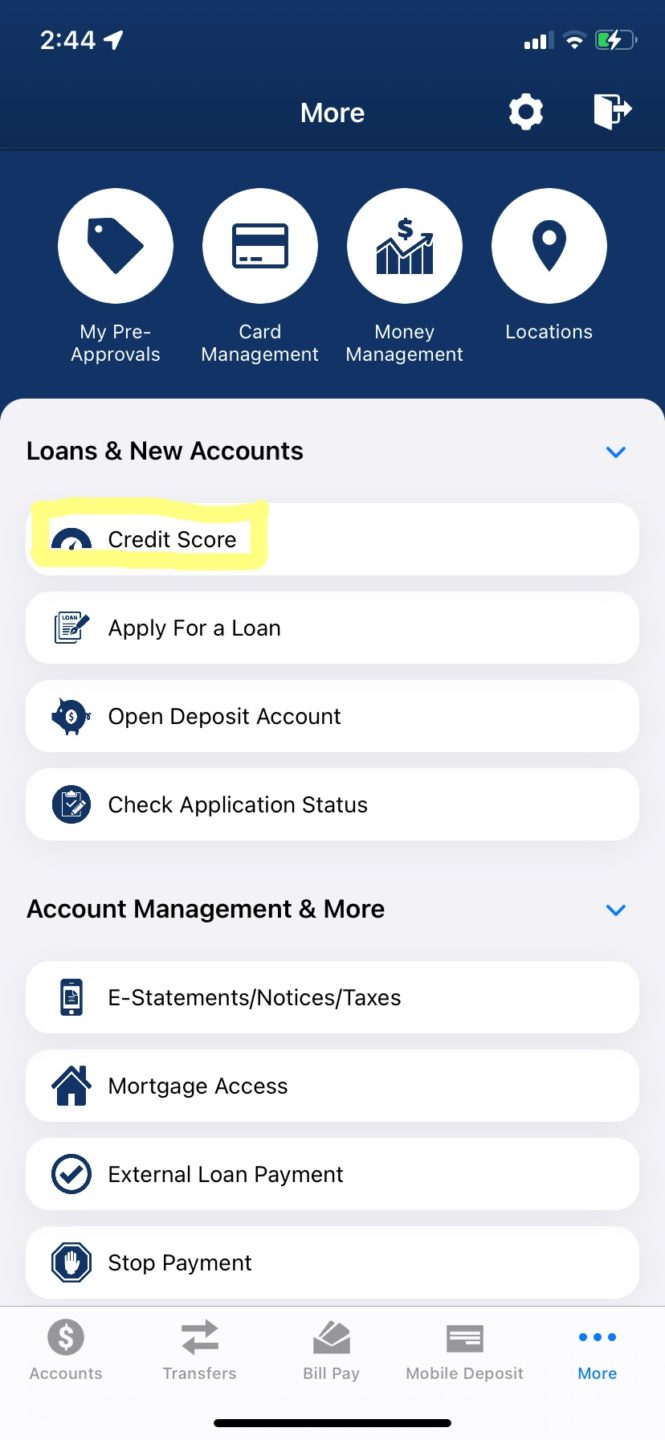

Mobile App:

To activate and use this free service in the mobile app, tap the “More” button in the bottom right corner. Then, tap “Credit Score.”

Digital Banking:

Need to enroll in Digital Banking? Click “signup” in the Digital Banking box on the left side of this page.

Mobile App:

Digital Banking:

Once activated, your credit score will be visible on your account dashboard upon logging in.

By leveraging these tools, you can take proactive steps to improve your credit score, making it easier to achieve your financial goals. Whether you’re aiming to qualify for better loan rates, secure a mortgage, or simply boost your creditworthiness, Credit Score offers the support you need.

Related Content: The Advantages of Using Credit Cards for Your Everyday Expenses

Want more credit union information?

Subscribe to eNews