January 01, 2023

Creating Your Budget with Money Management

It’s time for New Year’s Resolutions and we’re here to help you with the most common resolution made every year – budgeting. Start the year off the right way by building a budget within our FREE Money Management tool. Because once you realize where your money is being spent, you can find ways to economize.

What is Money Management?

Money Management is a FREE tool that allows you to view all of your financial accounts (internal and external) in one place. All of your accounts are added automatically. It shows your spending from all accounts and categorizes your transaction based on categories like shopping, groceries, entertainment, etc. One of the coolest features about Money Management is the budgeting features, which gives users the ability to auto-create a budget for you based on your current spending history.

How to Access Money Management

To access Money Management within our mobile banking app:

- Login to Mobile Banking.

- Click on the More tab at the bottom of the screen.

- Select Money Management.

How to Auto-Generate and Customize Your Budget

Before getting started, make sure all of your financial accounts have been added to Money Management. The more complete your spending history, the more accurate your budget will be.

- Click on the Budgets tab by selecting the dotted icon at the top left of the screen, and then Auto-Generate Budgets. Budgets will calculate your average spending in multiple categories from the last 90 days.

- Click Save Budget when you’ve finished making changes to your auto-generated budget.

- Bubbles will show categories of your spending. Red show budgets have been exceeded in this category. Yellow bubbles show spending has reached over 80% of their allowance. Green bubbles are well within their limits. Click on a bubble to access specific details about each particular bubble’s budget.

If you want to be notified about when you are close to or have exceeded your budget, you can sign up for alerts.

To sign up for alerts:

- Click on the toolbar at the top far right of the screen.

- Scroll down to budgets and select whether you’d like an email and/or SMS notification when exceeding your budget. Complete the same steps if you’d like to be notified when you’re projected to exceed your budget.

There are some other cool features within Money Management that you can use to keep track of your spending habits in more detail and how to pay down your debt.

Track Spending

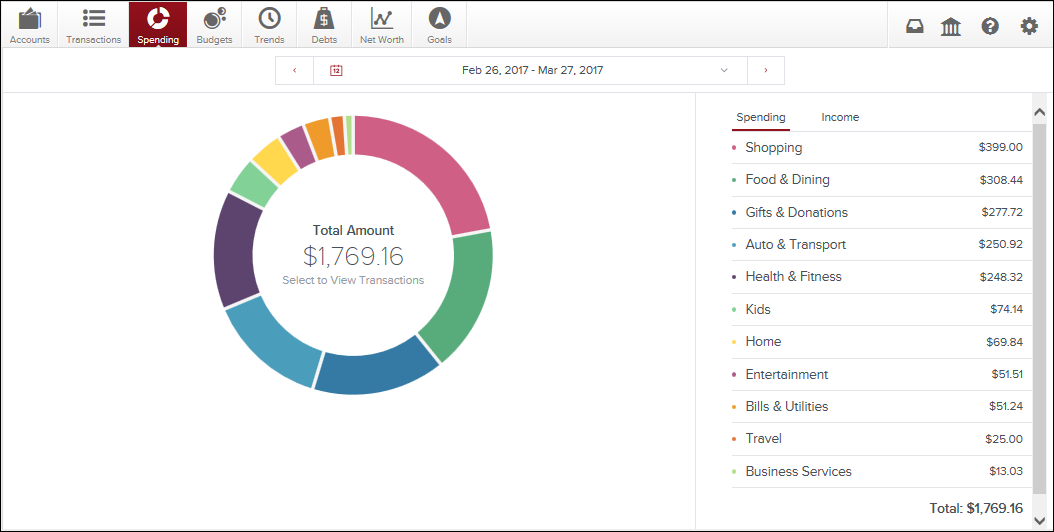

You can track spending within the Spending tab, which shows where your money is going by category, so you can better understand your spending habits and stay on track.

Click on a section of the wheel to see how much you’ve spend in each category.

Some categories you will see are:

- Shopping

- Food & Dining

- Gifts & Donations

- Auto & Transport

- Health & Fitness

- Bills & Utilities

- Home

- Travel

- Entertainment

Debt Payoff

Having debt on your plate is inevitable. Therefore, it’s important to track down how much you owe and who you owe.

In Loan Details under the Debts tab, you can click on any debt in your list to view the details of a loan in order to manually add the minimum payment and interest rate. You can also add the due date for a debt.

In Debt Snowball Strategy, users can expedite their debt reduction without increasing the monthly contribution toward debt. To follow the debt snowball strategy, you should “roll over” your monthly minimum payments as each debt is fully repaid. This will help you get out of debt faster, without the need for painful budget cuts.

For more information on how to effectively to use all the Money Management tool has to offer, click here.

Related: Paperless Budgeting & Trending

Want more credit union information?

Subscribe to eNews