Checking Accounts

Interior Federal will be launching the Digital Spend Account (DSA). The DSA offers a high annual percentage yield and loyalty rewards based on stated qualifications and membership tenure. If you already have the current checking account, you may continue to use it as is and it will become known as our “legacy checking account,” OR convert to the DSA as early as January 2nd.

Some banks tie you down. Not Interior Federal! Our checking accounts come with digital banking services+ to give you the freedom to bank whenever and wherever it’s best for you.

- Earn dividends

- No monthly fees

- No minimum balance requirement

- No per check charges

- Convenient digital banking

- Free Bill Pay, e-Statements and Money Management tool

- Overdraft protection

- Access to 95,000 totally-free ATMs worldwide^

- Access to 5,400 Shared Branches to conduct in-person transactions

- First 5 transactions per month are fee-free if using an out of network ATM

Manage your account through our mobile app:

Want to learn how to manage your money better? Get free tips and advice by visiting our Financial Resource Center. We also offer special checking accounts for Teens and Young Adults.

Debit cards and checking accounts go hand-in-hand! Of course, with your debit card you can make in-store and online purchases, but you can do much more!

- Digital Wallets– Add your debit card to Apple Pay, Samsung Pay, Google Pay, or Garmin Pay. Digital Wallets will make your transactions more secure and easily facilitate your transactions. Click here for step-by-step instructions to upload your card to your digital wallet.

- Visa Secure– Much like Digital Wallets, you can register your Interior Federal debit card with Visa Checkout and pay for online purchases with ease.

- Card Management– This service is available for debit card holders in Digital Banking. Card Management allows you to control your debit card usage by: Setting alerts and notifications, turning your card On/Off instantly, blocking international transactions, and setting transaction limits.

- CONTACTLESS for easier checkout and added security.

Learn more about the Interior Federal Visa® Debit Card

| Balances^ | Dividend Rate | APY* |

|---|---|---|

| Up to $1,499.99 | 0.05% | 0.05% |

| $1,500 and up | 0.05% | 0.05% |

Introducing our new check design that features elements of our new brand! As part of this update, we have also made our custom checks the most cost efficient option for our members.

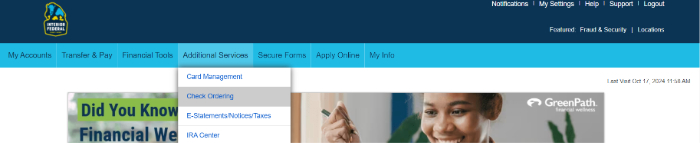

Here’s how to order/re-order checks:

- Login to Online Banking

- Navigate to the top menu and click “Additional Services”

- In the drop down, click on “Check Ordering”

- On the checks website, select “Personal Checks” from the menu

- Scroll down and click on “Interior FCU Custom”

- Make your selections and complete the checkout process

To open a checking account, you must be a member of Interior Federal. Establishing your membership is easy – just open a primary share savings account. See if you’re eligible for membership. For additional information or assistance, please call us at 800-914-8619.

*APY = Annual Percentage Yield. For more information, see our Schedule of Fees and Charges, Truth-In-Savings Disclosure and Membership Disclosure.

+Message or data rates may apply depending on your wireless plan.

^Although our ATM fees for Young Adult and Teen Accounts are waived for transactions performed at our ATMs and on those in the totally-free networks (AllPoint, Alliance One, Cirrus, Co-Op, CUHERE, and Visa) there may be a charge from foreign ATM networks and/or ATM owners. A foreign ATM is defined as not being part of the Credit Union’s surcharge-free ATM networks.

Young Adult Accounts

If you’re age 18-26, check out our Young Adult accounts.

If you’re age 18-26, check out our Young Adult accounts.